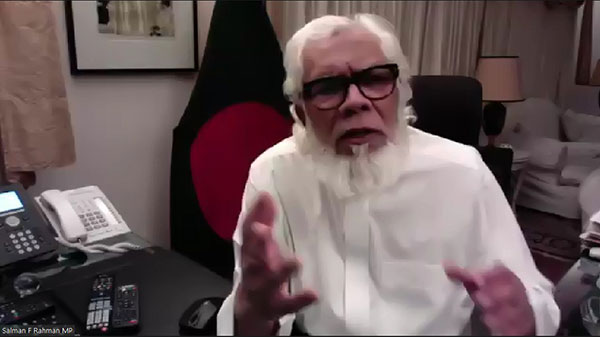

Salman F Rahman, Adviser to the Prime Minister on Private Industry and Investment, said stock exchanges have equal responsibility in containing manipulation into the trade.

But still the company that is closed in our capital market and everyone knows that, still the price of that company goes up. The stock exchange knows who buys and sells shares of these companies. The manipulation that is happening here and being done openly, no one is doing it in secret. But whenever the market collapses, people take to the streets and blame the government.

He was speaking as the chief guest at a seminar on “Latest Capital Market Situation and Sustainable Development” on Saturday (October 31st). The webinar was jointly organized by the Capital Market Journalists Forum (CMJF) and the Bangladesh Merchant Bankers Association (BMBA).

The meeting was attended by BSEC Chairman Prof Shibli Rubaiyat-ul-Islam, FBCCI President Sheikh Fazle Fahim and DCCI President Sams Mahmud as special guests. BMBA First Vice President presented the main article. Moniruzzaman.

Expressing solidarity with the BSEC chairman, Salman F Rahman said the Dhaka and Chittagong stock exchanges have very important responsibilities. The responsibility of the capital market rests solely with the government, the finance ministry and the BSEC, and the stock exchange will sit idly by. They have to be strong.

He said that every day the stock exchanges are being manipulated in front of their eyes and under their noses, what action have they taken. They are the brokers who are doing all this. So what action has been taken. So we have to change the mentality of blaming the government. It has to do with moving towards a mature market.

“We are optimistic about the market,” he said. In this case, DSE has to fulfill its responsibility in the same way as everyone is working. He further said that it was the responsibility of the government to provide protection to retail investors and to get out of this predicament. You have invested, you have to know. Profit-loss is yours. I also lost a lot of people to say, at that time I say how much profit you have made. I want BO account for analysis.

Then I say did you just make a loss, when you had a profit, you did not sell, you sat in the hope of more profit out of greed. So that the market has fallen and now it has gone into loss. Now blame the government. We need to get out of this mental state. Whoever will invest, they have to invest knowingly.

Noting that there are no institutional investors in our market, he said it is a big weakness. More than retail investors. About 60-65% of retail investors trade on stock exchanges. The contribution of institutional investors is very low. And the share of mutual funds in the market is said to be 3 percent but there is no more in the transaction. It goes without saying that there is no institutional investor without ICB. But a market cannot run with ICB alone.

“We have come up with the idea that investing here means getting a dividend,” he said. This is not the case in other markets. But big IT companies in other countries do not pay any dividend. Even then the regular share price is rising. This is gaining capital. But here we have different categories to pay dividends to protect retail investors.

“We are talking a lot about the supply side,” he said. There is talk of different types of incentives to bring the company. Everywhere there is talk of increasing this supply. But I think demand should also increase. There is provident fund, insurance money to increase this demand. Demand can also be increased by digitizing BO accounts. Banks can now open online accounts. If you can open a BO account in this way, it will help the demand side.